How AI is Transforming Fraud Prevention with Intelligent Document Processing

Fraud is a growing threat across industries, from finance and retail to loyalty programs. Fraudsters exploit loopholes in traditional fraud detection systems, using tactics like fake invoices, identity theft, and manipulated receipts. Most businesses still rely on manual reviews, which are slow, prone to errors, and often detect fraud only after the damage is done. As fraud tactics become more sophisticated, businesses need a proactive, intelligent solution.

AI-powered Intelligent Document Processing (IDP) is changing the game. It enables real-time document verification, detects anomalies instantly, and prevents fraud before it occurs. Let’s explore how AI-driven IDP works and how it is transforming fraud prevention across industries.

What is Intelligent Document Processing (IDP)?

IDP is an AI-powered technology that automates data extraction, classification, and verification from structured and unstructured documents. Unlike rule-based fraud detection, which relies on manual checks or keyword matching, IDP understands context, patterns, and irregularities. Using machine learning (ML), natural language processing (NLP), and optical character recognition (OCR), AI scans and authenticates documents in real time, making fraud detection faster and more reliable.

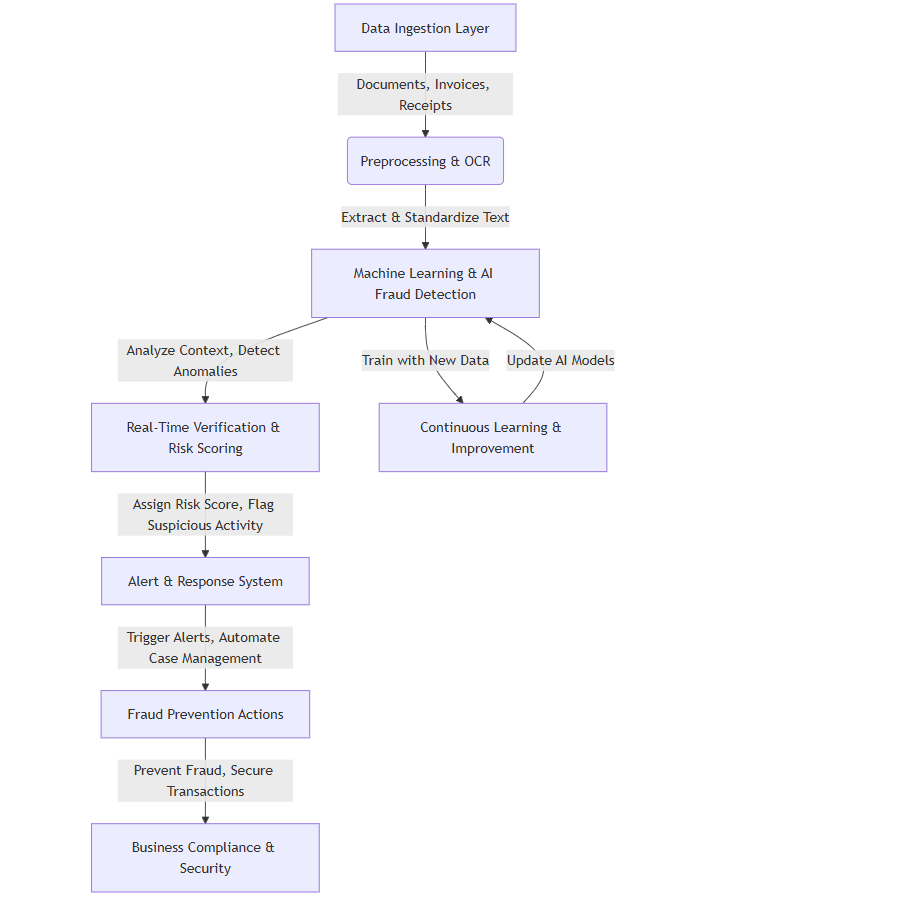

System Architecture: AI-Powered Fraud Prevention Workflow

How AI Enhances Fraud Detection

With AI-driven IDP, businesses can:

- Detect anomalies instantly - AI scans thousands of documents, identifying irregularities in invoices, receipts, and identity records that humans might overlook.

- Verify document authenticity - AI cross-references data across multiple sources, detecting manipulated text, forged signatures, and fake documents.

- Identify duplicate or altered submissions - Fraudsters often modify receipts or submit duplicate claims. AI flags inconsistencies in real time.

- Reduce false positives - AI continuously learns and improves accuracy, minimizing incorrect fraud alerts.

- Scale fraud detection effortlessly - AI processes millions of documents at scale, reducing the burden on human teams.

Traditional fraud detection methods - manual audits and rule-based systems—are slow, expensive, and limited in scope. AI overcomes these challenges by continuously evolving to detect new fraud tactics.

AI-Powered Fraud Detection Across Industries

Fraud affects businesses in multiple ways, including loyalty program abuse, invoice fraud, and identity theft. AI-driven IDP is transforming fraud prevention across industries.

1. Preventing Loyalty Fraud in Rewards Programs

Loyalty programs reward genuine customers, but fraudsters manipulate these systems by:

- Creating multiple accounts to claim sign-up bonuses repeatedly

- Submitting fake or altered receipts to earn points without making purchases

- Abusing refund and return policies to retain points after a reversed transaction

- Hacking accounts to steal and redeem someone else’s loyalty points

Case Study: A leading airline loyalty program implemented AI-powered IDP to detect fraudulent mileage claims. The system identified 30% of transactions as suspicious, leading to enhanced fraud prevention policies and reducing revenue leakage by $2 million annually.

How AI helps:

- AI scans receipts for forgeries, duplicates, and altered information.

- Machine learning detects unusual transaction behaviors, flagging suspicious claims.

- AI-powered authentication ensures real customers benefit from rewards, preventing bot-driven abuse.

With real-time fraud detection, businesses can prevent loyalty fraud while ensuring genuine customers are rewarded.

2. Stopping Invoice & Expense Fraud in Finance & Accounting

Invoice fraud costs businesses billions annually. Common tactics include:

- Invoice tampering – Fraudsters alter amounts or vendor details to redirect payments.

- Duplicate claims – Submitting the same invoice multiple times for reimbursement.

- Fake receipts – Generating counterfeit receipts for fraudulent expenses.

Case Study: A multinational corporation faced ongoing invoice fraud issues, with an estimated loss of $5 million annually. By integrating AI-driven IDP, the company reduced fraudulent claims by 40% within the first year and increased auditing efficiency by 60%.

How AI helps:

- AI extracts and verifies invoice data, cross-checking it against existing records.

- Machine learning identifies overinflated amounts, mismatched dates, and suspicious vendors.

- AI automates compliance checks, ensuring adherence to company policies and tax regulations. With AI-driven IDP, finance teams can speed up invoice verification, eliminate fraudulent payouts, and reduce manual workload.

3. Preventing Loan & Mortgage Fraud in Banking

Fraudsters use falsified documents and stolen identities to secure loans they don’t intend to repay. Common fraud techniques include:

- Document forgery – Altered bank statements and pay stubs exaggerate income or hide liabilities.

- Identity theft – Fraudsters apply for loans using stolen personal information.

- Synthetic identity fraud – Combining real and fake information to create high-credit-score profiles.

Case Study: A major financial institution detected a surge in synthetic identity fraud, leading to loan defaults totaling over $10 million. Implementing AI-powered IDP reduced fraudulent loan applications by 50% in just six months, strengthening the institution's risk management.

How AI helps:

- AI detects inconsistencies in financial documents and forged text.

- AI-powered biometric verification ensures applicants’ identities are legitimate.

- Machine learning scans multiple data sources to spot unusual credit patterns.

- Real-time fraud risk assessment prevents high-risk loans from being approved.

By integrating AI, banks can reduce fraud-related losses and strengthen security.

The Future of Fraud Prevention is AI-Driven

Fraud tactics are constantly evolving. Rule-based systems and manual reviews are no longer enough. Businesses must adopt AI to stay ahead. AI-driven fraud detection:

- Learns and adapts - AI continuously improves detection accuracy.

- Processes massive data volumes - Millions of documents can be analyzed in seconds.

- Reduces financial and reputational risk - Prevents fraud before it occurs, rather than after the damage is done.

Is your business ready for AI-powered fraud detection?

TechStaX: Your AI Fraud Prevention Partner

At TechStaX, we specialize in AI-powered solutions that automate fraud detection, enhance security, and optimize document processing. Our IDP technology helps businesses prevent fraud, scale efficiently, and improve compliance.

TechStaX has successfully helped enterprises detect fraudulent transactions, prevent revenue leakage, and safeguard their operations with cutting-edge AI technology.

Don’t let fraud drain your business. Partner with TechStaX today and stay ahead of emerging threats. Contact Us today

Stay Updated with Our Newsletter

Join our community and receive the latest insights, tips, and exclusive content directly to your inbox.